Ai Tools for Accounting: Streamline Your Finances!

AI tools for accounting, such as QuickBooks and Xero, incorporate machine learning to optimize financial tasks. They streamline processes, enabling more accurate and efficient accounting.

AI-powered accounting tools are revolutionizing the financial industry by automating repetitive tasks, reducing the likelihood of human error, and providing deep insights into financial data. These innovative tools can handle a spectrum of functions, from simple bookkeeping to complex tax strategies, and are designed to support both small businesses and large corporations.

By leveraging advanced algorithms, AI accounting tools ensure that financial records are meticulous and up-to-date, which is critical for decision-making and compliance. Embracing AI technology in accounting not only increases productivity but also offers competitive advantage through improved accuracy and strategic financial analysis. As businesses strive for efficiency and precision, AI tools are becoming an indispensable part of the modern accounting landscape.

Credit: www.aitoolmate.com

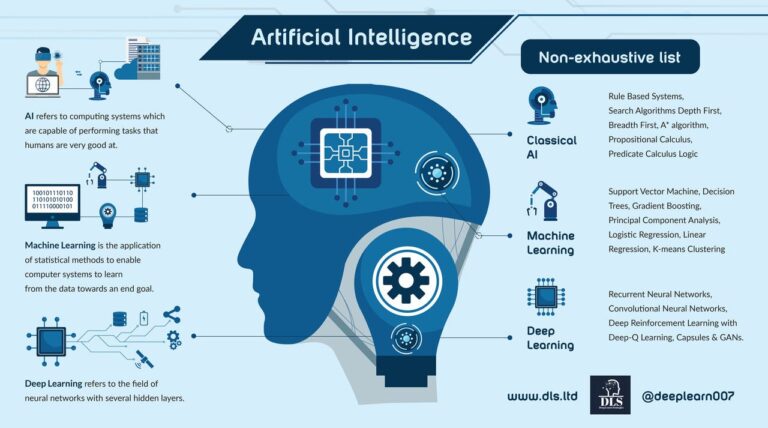

The Rise Of Ai In Finance

The finance sector is witnessing a transformative shift with Artificial Intelligence (AI) reshaping how businesses handle their finances. This technological revolution brings efficiency, accuracy, and unprecedented speed to a traditionally meticulous domain.

Transforming Accounting Practices

AI in accounting is a game-changer. It automates routine tasks, processes large volumes of data, and offers analytical insights. This shift means accountants can focus on strategic decision-making rather than get bogged down with data entry and number crunching.

- Automated Data Entry: AI software quickly categorizes and enters transactions.

- Error Reduction: AI minimizes mistakes in financial records.

- Real-time Reporting: Instant reports keep businesses updated.

Benefits For Businesses

Companies gain significant advantages by integrating AI into their financial operations. The edge AI provides is multi-faceted, impacting various aspects of business performance.

| Benefit | Details |

|---|---|

| Cost Savings | Reduces labor and operational costs via automation. |

| Accuracy | Lessens risk of human error, enhancing data integrity. |

| Speed | Processes financial transactions at an accelerated pace. |

| Scalability | Easily adapts to growing transaction volumes. |

Companies apply AI not just for efficiency but also to stay competitive in a digital world. Embracing AI means leveraging powerful insights that could be the difference between staying afloat and surging ahead in finance.

Popular Ai Tools In The Accounting Sector

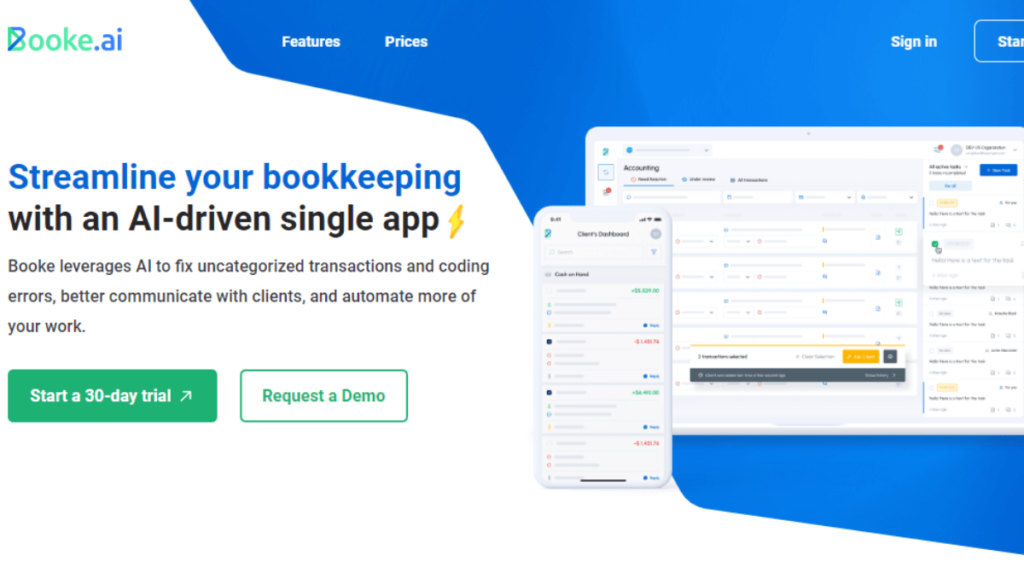

The landscape of accounting has transformed with the emergence of AI tools. These advancements optimize tasks, reduce errors, and enhance decision-making. Let’s explore popular AI tools in the accounting sector that are reshaping financial management.

Software For Automated Bookkeeping

Automated bookkeeping software employs AI to streamline financial record-keeping. It ensures accuracy and saves time. Here are a few leading solutions:

- QuickBooks: Automates expense tracking and invoicing.

- Xero: Uses machine learning for transaction categorization.

- Wave: Offers receipt scanning and bank reconciliation features.

Ai-driven Financial Forecasting

Financial forecasting powered by AI predicts future financial trends. This helps businesses plan better. Popular tools include:

| Tool | Feature |

|---|---|

| PlanGuru | Predicts financial outcomes with analytics. |

| Centage | Delivers budgeting and forecasting solutions. |

| Futrli | Provides cash flow forecasts using AI. |

How Ai Enhances Accuracy And Efficiency

Artificial Intelligence (AI) is revolutionizing the accounting sector by bringing in unprecedented accuracy and efficiency. Integrating AI into accounting software and processes is streamlining complex calculations, reducing the margin for error, and expediting financial tasks. Let’s delve into how these intelligent systems are elevating the standards of financial management.

Reducing Human Error

AI’s capacity to learn and adapt is minimizing human errors in accounting records. By automating data entry and complex calculations, AI ensures that financial statements are precise and reliable.

- Automated data entry – AI systems import and categorize financial information with high accuracy.

- Error detection algorithms – These tools quickly identify and correct mistakes that might otherwise go unnoticed.

- Consistent application of rules – AI applies accounting rules uniformly, making sure every transaction adheres to the latest standards.

Speeding Up Financial Processes

AI accelerates all aspects of accounting, from bookkeeping to reporting. By handling tasks at a pace no human can match, AI is liberating accountants to focus on strategy.

| Task | Traditional Time | AI-Enabled Time |

|---|---|---|

| Transaction Categorization | Hours | Minutes |

| Report Generation | Days | Hours |

| Audits | Weeks | Days |

- Real-time processing – AI analyses transactions instantly, leading to timely financial insights.

- Automated reconciliation – AI effortlessly matches records, speeding up one of the most tedious accounting tasks.

- Instant reporting – AI compiles comprehensive reports swiftly, aiding quick decision-making.

Integration Challenges And Solutions

Embracing AI in accounting often comes with its share of integration hurdles. Solutions lie in understanding these challenges and resolving them with strategic steps. Let’s dive into key areas where difficulty may arise and how to address them effectively.

Navigating The Learning Curve

User adoption plays a big role in integrating AI tools. These steps can ease the process:

- Comprehensive Training: Offer detailed guides and workshops.

- Phased Roll-Out: Introduce features in stages.

- Support Resources: Provide continual assistance with FAQs and helpdesks.

Ensuring Seamless Data Transfer

Data is the backbone of AI accounting tools. To maintain integrity and prevent loss:

- Review Current Data: Check for accuracy before transfer.

- Choose Compatible Formats: Ensure the new system supports existing data files.

- Test Transfers: Run trials to catch errors early.

With these measures, data integration is more secure and reliable.

Future Trends In Ai And Accounting

The landscape of accounting is rapidly transforming with AI technologies. These advancements promise to revolutionize traditional methods. Accountants need to adapt as AI shapes the future of finance. Let’s explore the upcoming trends.

Predictive Analytics In Finance

Predictive analytics is changing how businesses forecast financial outcomes. AI tools analyze vast data sets to identify trends. They predict future financial scenarios with high accuracy. This enables smarter, data-driven decisions.

- Risk Assessment: AI predicts risks before they become issues.

- Revenue Forecasting: Companies know potential earnings in advance.

- Cash Flow Analysis: AI monitors and forecasts company cash flows.

The Evolving Role Of Accountants

AI does not replace accountants; it enhances their role. Accountants will focus more on strategic planning. They will also guide AI-driven insights. Their work becomes more innovative and analytical.

| Traditional Role | Future Role |

|---|---|

| Data entry and bookkeeping | Strategic advisory |

| Tax preparation | AI-driven tax optimization strategy |

| Manual reporting | Interpreting AI-generated reports |

Credit: chrome.google.com

Credit: www.datarails.com

Frequently Asked Questions For Ai Tools For Accounting

Is There Any Ai Tool For Accounting?

Yes, several AI tools for accounting exist, such as QuickBooks Online, Xero, and FreshBooks, which offer automated bookkeeping and financial management features.

What Is Ai Used For In Accounting?

AI in accounting streamlines data processing, enhances accuracy, automates repetitive tasks, provides predictive analysis, and assists in decision-making by analyzing large financial datasets.

Which Ai Tool Is Best For Finance?

The best AI tool for finance varies based on need, but IBM Watson stands out for its advanced analytics and data processing capabilities.

Can You Use Chatgpt For Accounting?

ChatGPT assists with accounting by automating data entry and providing financial insights. However, it cannot replace a professional accountant for complex tasks.

Conclusion

Embracing AI in accounting is no longer optional, it’s essential. Whether streamlining processes or enhancing accuracy, these tools offer a competitive edge. They transform data into actionable insights, paving the way for smarter financial decisions. Harnessing AI’s power will undoubtedly shape the industry’s future, ensuring accountants stay ahead in a digital-driven world.

Let AI be the ally that propels your accounting to new heights.