Ai Tools for Financial Modeling: Boost Your Analysis!

AI tools for financial modeling enhance accuracy and reduce time spent on data analysis. They streamline complex financial tasks through automation and algorithms.

Financial modeling is a critical process in business planning, investment analysis, and risk management that requires precision, efficiency, and deep analytical insights. AI tools such as TensorFlow, Keras, and IBM’s Cognos Analytics leverage machine learning and predictive analytics to transform bulky financial datasets into actionable information.

They provide sophisticated capabilities for scenario analysis, forecasts, and valuation, greatly surpassing traditional spreadsheet-based models. By employing these AI-driven systems, finance professionals can make data-driven decisions swiftly, ensuring competitive advantage in a fast-paced economic landscape. The integration of AI in financial modeling brings a new era of data interpretation, offering streamlined workflows and precision that revolutionize financial strategies.

Credit: www.synthesia.io

The Evolution Of Financial Modeling

The journey of financial modeling has been remarkable. It began with pen and paper. Now, artificial intelligence (AI) shapes its future. Let’s explore this transformation.

From Spreadsheets To Ai

Spreadsheets were a revolution. They allowed complex calculations. They needed manual input though. Mistakes were common. AI changes this. It brings speed and accuracy. Data analysis gets easier.

Here are significant shifts:

- User error reduction: AI minimizes manual data entry errors.

- Time-saving: Automated processes cut down modeling time.

- Advanced analytics: AI provides deeper insights from data.

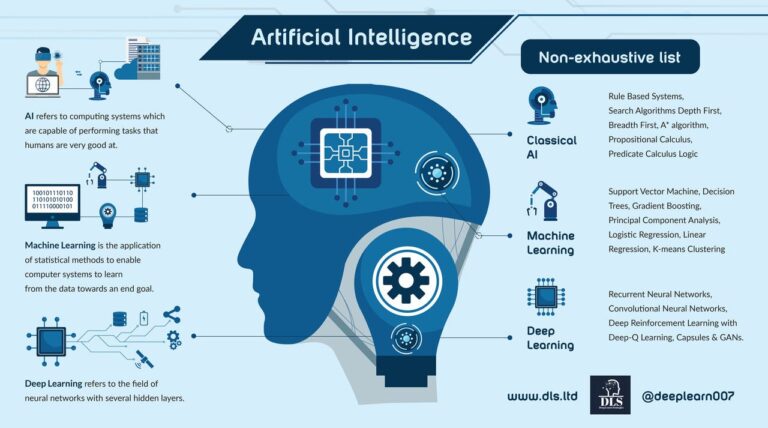

The Rise Of Machine Learning In Finance

Machine Learning (ML) uses data to make predictions.

ML models learn from data patterns. They get better over time. They can predict market trends. They help in making smarter investment decisions. Look at its benefits:

| ML Feature | Advantage |

|---|---|

| Pattern Recognition | Identifies market signals quickly. |

| Risk Assessment | Improves accuracy in predicting risks. |

| Real-Time Analysis | Makes instant decisions possible. |

AI and ML tools offer vast improvements over traditional spreadsheets.

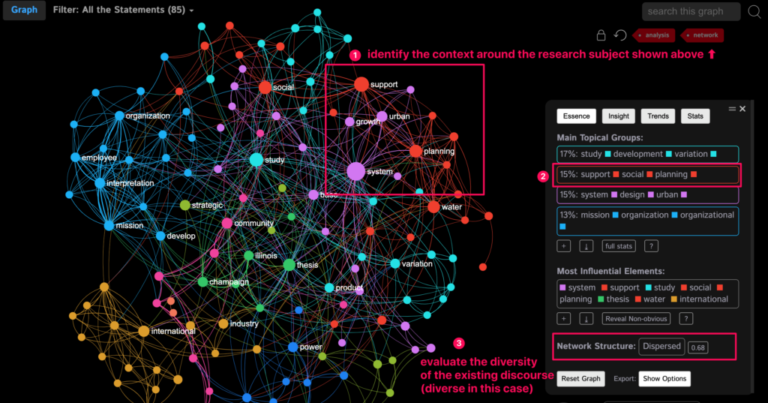

Ai In Financial Projections

Modern finance teams embrace AI tools to predict future financial outcomes with greater accuracy. AI in Financial Projections elevates traditional models. It offers deeper insight and a competitive edge.

Predictive Analytics For Revenue Forecasting

Predictive analytics use historical data to forecast revenue. AI algorithms identify patterns and trends. They provide businesses with informed projections.

- Efficiently analyze past sales data

- Spot seasonal trends and customer purchasing behavior

- Adjust quickly to market changes

Companies gain a forward-looking perspective. They better prepare for future demand.

Deep Learning For Market Trends Analysis

Deep learning digs deeper into market data. It uncovers subtle trends. This AI subset uses neural networks for sophisticated analysis.

Key benefits include:

| Benefit | Description |

|---|---|

| Real-time Insights | Immediate data analysis for timely decisions. |

| Enhanced Accuracy | Fine-tune market predictions with complex datasets. |

| Long-term Strategies | Unveil long-term market prospects and risks. |

Businesses stay a step ahead. They adapt strategies based on real-time global market analysis.

Risk Management And Ai

Risk Management and AI have become inseparable in the modern finance sector. Financial experts use AI to predict risks better.

Quantifying Uncertainties With Ai

AI excels in finding patterns in vast data. This skill is crucial for anticipating financial risks. Firms can now quantify uncertainties like never before.

AI considers market trends, global events, and internal data. This results in a comprehensive risk assessment.

- Real-time analysis: AI provides updated risk evaluations.

- Probability predictions: It gauges the likelihood of risk scenarios.

- Adaptive learning: The more data AI gets, the smarter it gets.

Stress Testing And Scenario Analysis

Stress testing is crucial in finance. It shows how systems handle tough situations. AI-powered stress testing simulates extreme market conditions.

| Feature | Benefit |

|---|---|

| Dynamic Scenarios | AI creates tests using current data. |

| Predictive Insights | AI forecasts potential market crashes. |

| Customizable Models | Firms can adjust AI tools to their needs. |

Scenario analysis with AI helps companies prepare better. AI evaluates multiple outcomes, giving businesses a clear strategy.

Ai-driven Decision Making

AI-Driven Decision Making shakes the very foundation of traditional financial modeling. Gone are the days of static spreadsheets and gut feelings. Modern finance professionals harness powerful AI tools to analyze trends and predict outcomes with unprecedented precision.

Real-time Analysis For Investment Decisions

In the fast-paced world of finance, timely decisions are critical. AI tools offer real-time data analysis, giving investors a significant edge. This cutting-edge technology processes vast amounts of market data, providing actionable insights that were once impossible to uncover.

- AI tracks global market trends.

- It identifies investment opportunities instantly.

- Predictive models adjust to new data on-the-fly.

Investors with AI at their fingertips make informed decisions faster.

Integrating Ai Insights Into Strategic Planning

Strategic planning no longer relies on annual forecasts alone. AI tools infuse plans with a blend of historical data and predictive analytics, leading to strategies that adapt to market dynamics. This integration ensures a company’s resilience against financial storms.

- AI analyzes past performance against market conditions.

- It projects future scenarios through simulation.

- Strategies evolve as new data flows in.

Companies leveraging AI insights foster long-term stability and growth.

Tools And Platforms For Ai-enhanced Financial Modeling

In the finance industry, precision and efficiency are paramount. AI-enhanced tools transform financial modeling, enabling professionals to deal with vast data arrays, predict market trends, and optimize investment strategies with unprecedented accuracy. The following sections will explore AI tools and customization strategies that are revolutionizing financial analytics.

Popular Ai Tools For Finance Professionals

AI tools are reshaping financial analysis and decision-making. They offer robust predictive models, automate complex calculations and streamline portfolio management. Here’s a look at some leading AI tools that finance professionals heavily rely on:

- Quantrix: Offers scenario analysis and forecasts through its dynamic model-building platform.

- Alteryx: Simplifies analytics with an intuitive workflow, making data blending and advanced analytics accessible.

- DataRobot: Delivers machine learning to build accurate predictive models efficiently.

- Kensho: Provides analytics for financial events with an emphasis on impact prediction.

Customizing Ai Solutions For Complex Financial Models

Not all financial challenges have off-the-shelf solutions. Customized AI platforms are key to handling sophisticated models. Organizations can tailor AI algorithms to suit their unique needs, optimizing performance across diverse financial functions. Steps to customize include:

- Identifying specific financial modeling goals.

- Gathering quality datasets for training AI.

- Developing unique algorithms or modifying existing frameworks.

- Continually testing and refining the AI model for accuracy.

Custom AI solutions provide a competitive edge by addressing niche areas within financial markets, offering a more tailored approach to risk assessment, and helping to maximize returns.

Credit: www.elegantthemes.com

Adopting Ai In Financial Teams

Financial teams are now turning to AI for smarter, faster decisions. Embracing AI means more than just new tools. It’s a journey towards modern finance.

When financial teams bring AI into their workflow, they open doors to incredible efficiency and accuracy. This shift is not just about technology. It involves training people and changing the team culture to be more data-centric. Let’s explore this transformative phase.

Training And Skills Development

AI demands new skills in financial teams. Here’s how firms can prepare:

- Workshops on AI basics

- Online courses for deep learning

- Certification programs in data analytics

Introducing these training elements ensures everyone speaks the same data language.

The Cultural Shift Towards Data-driven Finance

Finance is evolving with data at its core. This cultural shift means:

- Emphasizing data insights over gut feeling

- Making decision-making transparent with AI

- Driving a company-wide commitment to data

This new culture champions data as the new currency of finance.

| Before AI | After AI |

|---|---|

| Intuition-based decisions | Data-driven decisions |

| Manual data analysis | Automated insights |

| Limited forecasting | Advanced predictive models |

Credit: www.simplilearn.com

Frequently Asked Questions For Ai Tools For Financial Modeling

Can Ai Do Financial Modelling?

Yes, AI can perform financial modeling by analyzing large data sets and recognizing patterns to forecast financial outcomes with precision.

Which Ai Tool Is Best For Financial Analysis?

The best AI tool for financial analysis is often Bloomberg Terminal, known for its comprehensive data and analytics capabilities. Competitors like FactSet and S&P Capital IQ also offer robust analysis tools. Preference depends on specific feature needs and budget constraints.

Can Chatgpt Do Financial Modelling?

ChatGPT can assist in the initial steps of financial modeling by generating formulas and suggesting structures. It requires human oversight for complex, accurate models.

What Is The Best Tool For Financial Modelling?

The best tool for financial modeling is widely regarded as Microsoft Excel, known for its advanced features and flexibility.

Conclusion

Embracing AI tools for financial modeling can transform your analytics game. These sophisticated aids streamline complex data processing, delivering precision and speed. Ensure to choose wisely, staying ahead in the finance field. To stay informed on emerging AI advancements, continuously hone your skill set.

Let AI be your ally in navigating the financial future.