Ai Tools for Finance: Revolutionize Your Financial Strategy!

AI tools for finance optimize investment strategies and automate trading. They enhance risk management and fraud detection in financial services.

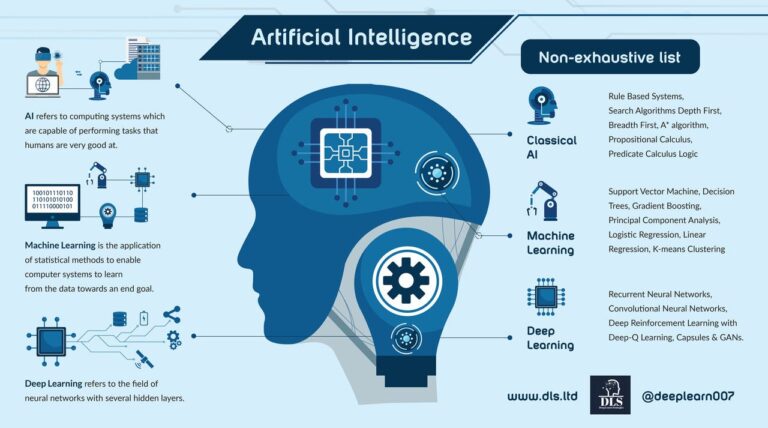

In the rapidly evolving world of finance, artificial intelligence (AI) has become an integral part of the industry’s technological advancement. These tools leverage machine learning algorithms, natural language processing, and data analytics to provide deeper insights into market trends and customer behavior.

Financial institutions and investors utilize these tools to streamline operations, personalize customer experiences, and make more informed decisions. By embracing AI, the finance sector offers innovative solutions in areas like portfolio management, predictive analytics, and algorithmic trading, thus revolutionizing how both individuals and companies approach their financial activities.

Credit: www.gartner.com

The Surge Of Ai In Finance

Today’s finance world is undergoing a major revolution thanks to Artificial Intelligence. Innovative tools and technologies powered by AI are reshaping how we manage finances. These AI-driven advancements are not just changing existing paradigms; they’re creating new possibilities in efficiency, accuracy, and predictive power.

AI is changing the finance game. This powerful tech is making processes faster and smarter. Let’s explore how AI tools are transforming finance right before our eyes!

Transforming Financial Analysis

Financial analysis is getting a huge boost from AI tools. These tools sort through data faster than humans. They make sense of complex patterns. This helps experts make smarter, data-driven decisions.

- Automated Reports: AI creates reports quickly, saving hours of work.

- Risk Assessment: It spots risks that could harm investments.

- Real-Time Analytics: Experts see immediate data to make quick calls.

Ai Algorithms In Investment Forecasting

AI is also playing a big role in investment forecasting. These smart algorithms predict market trends with great accuracy. They help investors decide what to do with their money.

| AI Feature | Impact on Forecasting |

|---|---|

| Predictive Analysis | Guesses future market moves. |

| Behavioral Data | Understands investor behavior. |

| Quantitative Models | Uses math to predict trends. |

Machine Learning Breakthroughs

The world of finance is witnessing a revolution. Machine learning is at the forefront of this transformation. Cutting-edge algorithms analyze vast datasets. They predict future market trends with unprecedented accuracy. Risk management, as well, has evolved. Deep learning algorithms now identify potential financial risks before they materialize. Let’s explore these exciting developments in detail.

Predictive Analytics For Market Trends

Predictive analytics use historical data to foresee market movements. Banks, investment firms, and insurance companies now harness this power. They make informed decisions based on data-driven insights.

- Stock Performance: Algorithms predict stock rises and falls.

- Consumer Behavior: Machine learning anticipates buying patterns.

- Market Shifts: Financial institutions get ahead of trends.

Deep Learning And Risk Management

Risk management is crucial in finance. Deep learning excels here. Financial entities can mitigate risks smartly. They protect their assets and ensure customer trust. Below are key areas where deep learning has made its mark:

| Credit Scoring | Fraud Detection | Operational Risks |

|---|---|---|

| Models predict loan default probabilities. | Systems detect anomalous transactions | Tools foresee and manage internal risks. |

Ai-powered Personal Finance

Managing money is now smarter and easier. AI tools help us understand and control our finances. Let’s dive into how artificial intelligence is revolutionizing personal finance.

Robo-advisors For Investment Strategies

Investing can be complex, but Robo-advisors simplify it. With AI, they learn your goals and risk appetite. They then craft personalized portfolios.

- Automated Portfolio Management: Robo-advisors keep an eye on your investments, rebalancing as needed.

- Low Fees: Enjoy investing with minimal costs.

- 24/7 Monitoring: Your portfolio gets constant attention.

Personal Budgeting With Ai Integration

AI Budgeting Tools track your spending patterns. They offer insights to save more.

| Feature | Benefit |

|---|---|

| Expense Tracking | See where every dollar goes. |

| Smart Insights | Get tips to cut costs effectively. |

| Bills Reminder | Never miss a payment date. |

AI makes budgeting stress-free. Staying on top of finances is now within everyone’s reach.

Evolving Regulatory Landscape

The financial world constantly evolves as technology integrates more deeply into its core functions. AI tools for finance are reshaping how we approach everything from investing to fraud detection. This evolution brings with it a complex and changing regulatory landscape.

Data Privacy And Ai

In the age of AI, data privacy remains a top concern for individuals and entities alike. As finance institutions leverage AI to deliver better services, they amass large quantities of sensitive data. This practice puts a spotlight on the need for robust data privacy regulations.

- GDPR in Europe

- CCPA in California

- PIPEDA in Canada

These regulations dictate the rules of data handling and protect consumer information.

Compliance Measures In The Ai Era

The integration of AI in finance does not come without its compliance challenges. Regulatory bodies are active in defining the framework for AI governance.

| Regulatory Body | Key Focus |

|---|---|

| FATF | Anti-Money Laundering |

| SEC | Market Integrity |

| FINRA | Risk Management |

Financial entities must stay abreast of these regulations to avoid sanctions and maintain consumer trust.

Case Studies And Success Stories

The world of finance is undergoing a massive transformation.

Artificial Intelligence (AI) is at the forefront of this change.

Let’s dive into real-world examples where AI has made a significant impact.

AI Transformations in BankingAi Transformations In Banking

Banks are leveraging AI to enhance customer experience and streamline operations.

- Customer Service: Chatbots provide 24/7 assistance.

- Fraud Detection: AI algorithms detect unusual patterns fast.

One notable success story comes from JP Morgan Chase.

Their AI platform, COiN, processes legal documents in seconds.

It saves up to 360,000 hours of human work every year.

Fintech Innovators Using AIFintech Innovators Using Ai

Fintech startups use AI to disrupt traditional banking.

Kabbage offers automated loan approvals for small businesses.

Upstart, a lending platform, approves personal loans using AI.

They assess the borrower’s risk differently and faster.

| Fintech Company | Innovation |

|---|---|

| Kabbage | Automated, data-driven loan decisions |

| Upstart | AI credit scoring model |

Such companies decrease loan processing time and increase approval rates.

Credit: www.facebook.com

The Future Of Finance With Ai

The intersection of artificial intelligence and finance is forging a new era of innovation. From automated trading to personalized banking services, AI is revolutionizing how we interact with money. As we gaze into the financial horizon, AI tools stand poised to transform the industry. Let’s delve into the expectations for AI’s impact over the next ten years and the interplay of challenges and opportunities this journey entails.

Predictions For Ai In The Next Decade

AI will redefine financial strategy and operations. Expect robust AI algorithms that anticipate market shifts and automate complex tasks. Banks will use AI to personalize services, making every customer feel like the only customer. Risk management will evolve with AI’s predictive prowess, mitigating potential crises before they erupt.

- Automated advisors will become more common.

- Real-time fraud detection will tighten security.

- Blockchain and AI will join forces for enhanced services.

| Year | Expectation |

|---|---|

| 2025 | Majority of trading is AI-driven. |

| 2030 | Digital assistants manage personal finances. |

Challenges And Opportunities Ahead

While AI promises a bright future, it presents hurdles as well. Data privacy remains a critical concern. Trust in AI systems needs to be established to ensure widespread adoption. Nevertheless, the opportunities are massive. Financial institutions that embrace AI will see enhanced efficiency and customer satisfaction.

- Challenges:

- Ethical use of AI

- Regulation compliance

- Data security

- Opportunities:

- New financial products

- Improved decision making

- Cost reduction

Credit: www.synthesia.io

Frequently Asked Questions For Ai Tools For Finance

What Is The Ai Tool Used In Finance?

AI tools commonly used in finance include machine learning algorithms, predictive analytics, and natural language processing for tasks like fraud detection, trading, and customer service.

How Ai Is Being Used In Finance?

AI in finance streamlines operations with automated trading, fraud detection, credit scoring, and personalized banking services, enhancing decision-making and risk management.

What Are The Ai Tools For Financial Advisors?

AI tools for financial advisors include Robo-advisors, predictive analytics software, risk assessment platforms, and customer relationship management (CRM) systems enhanced with AI. These technologies support decision-making, portfolio management, client interaction, and personalized advice.

Is There Any Ai Tool For Accounting?

Yes, there are AI tools for accounting, such as Xero, QuickBooks Online, and Sage, which help in automating financial processes and data analysis.

Conclusion

Embracing AI tools in the financial sector unlocks efficiency and accuracy previously unattainable. It’s clear that smart technology has cemented its role in finance. From risk assessment to algorithmic trading, AI’s influence is vast. Smart financial management is now synonymous with these innovative solutions.

Stay ahead; integrate AI into your financial strategies now.