Ai Tools for Private Equity: Revolutionize Your Investments!

AI tools for private equity optimize investment strategies and enhance due diligence processes. These tools employ algorithms for market analysis and predictive insights.

In the rapidly evolving landscape of private equity, advanced artificial intelligence tools are revolutionizing the way firms approach investments. They provide a competitive edge by processing vast amounts of data to identify patterns, trends, and potential risks that would be impossible to discern through human analysis alone.

As the financial sector becomes more data-driven, private equity firms increasingly rely on AI to drive decision-making, from sourcing potential deals to exit planning. By leveraging machine learning, natural language processing, and big data analytics, these tools can significantly improve investment outcomes, operational efficiencies, and strategic planning for private equity professionals.

Credit: www.facebook.com

Ai Tools In Private Equity

Artificial Intelligence (AI) is transforming how investment firms operate. In private equity, savvy firms utilize AI to gain a competitive edge. AI provides deep insights, enhances decision-making, and streamlines operations. It’s reshaping the private equity landscape.

The Rise Of Ai In Investment Strategies

AI has become a game-changer in formulating investment strategies. It helps firms analyze vast data sets quickly and accurately. AI tools predict market trends, assess risks, and uncover investment opportunities with precision.

- Market Analysis: AI algorithms process market data to forecast trends.

- Risk Assessment: AI evaluates potential investment risks in real-time.

- Opportunity Identification: Machine learning identifies profitable ventures.

Key Ai Technologies Shaping Private Equity

Several AI technologies stand out in their influence on private equity.

| Technology | Applications | Benefits |

|---|---|---|

| Machine Learning | Data analysis, pattern recognition | Smarter decision-making |

| Natural Language Processing (NLP) | Sentiment analysis, due diligence | Enhanced communication |

| Robotic Process Automation (RPA) | Operational tasks, data management | Efficiency improvements |

Machine Learning (ML) delves into data, predicting outcomes and trends. Natural Language Processing (NLP) interprets human language, aiding in due diligence. Robotic Process Automation (RPA) speeds up routine tasks, saving time and money.

Credit: www.listennotes.com

Streamlining Due Diligence

Streamlining due diligence is crucial in the high-stakes world of private equity. With AI tools, the process becomes faster and more efficient. Investors can now dive deep into data, streamline operations, and make informed decisions quickly. Let’s explore how AI transforms due diligence in private equity.

Automating Financial Analysis

Financial scrutiny is a pillar of due diligence. AI tools lift this burden by automating complex financial analyses. Firms save time and reduce errors by leveraging AI for tasks like:

- Cash flow projections

- Profit and loss analysis

- Balance sheet evaluations

AI algorithms quickly identify trends and anomalies in financial data. This information is critical for risk assessment and valuation accuracy.

Enhanced Market Research Through Ai

Understanding the market landscape is essential. AI tools offer an edge with deep market insights. They analyze:

- Consumer behavior patterns

- Competitor strategies

- Market trends and forecasts

These insights from AI market research empower private equity firms with up-to-date knowledge. Decisions become data-driven, backed by comprehensive research.

Portfolio Management Enhanced By Ai

The rise of artificial intelligence has revamped the private equity landscape. AI provides powerful tools to manage and grow portfolios. Private Equity firms can make smarter decisions with less risk. Let’s explore how AI is changing the game for portfolio management.

Predictive Analytics For Investment Decisions

AI transforms data into foresight. Predictive analytics uses machine learning. It guides where and when to invest. Complex algorithms crunch historical data. They foresee trends and outcomes. Firms can predict the future success of potential investments.

- Faster decision-making

- Reduced risks

- Improved investment accuracy

Investment accuracy is crucial for success. Reduced risks protect the bottom line.

Real-time Portfolio Monitoring

Tracking assets in real-time gives a competitive edge. AI tools offer constant oversight. They analyze performance indicators instantly. This enables quick action to manage opportunities or threats.

Stay ahead with live data:

- Instant financial updates

- Operational health snapshots

- Market trend alignment checks

Detailed insights keep firms informed. Informed decisions push growth. Real-time data is a treasure trove for portfolio managers.

Better Decision Making

Better Decision Making is at the core of private equity success. Modern AI tools transform mountains of data into clear strategies. They guide investors to make the smartest choices. Let’s dive into how AI shapes decision-making in private equity.

Data-driven Insights And Risk Assessment

AI algorithms excel in analyzing complex datasets. This ability helps in uncovering hidden opportunities and forecasting trends with precision. By leveraging structured and unstructured data, firms gain a comprehensive overview of potential investments. AI-driven models assess risks effectively, balancing potential returns with financial exposures.

- Historical Data Analysis: AI tools analyze past performance to predict future outcomes.

- Real-Time Market Conditions: Timely data ensures up-to-the-minute accuracy in risk assessment.

- Scenario Simulation: AI creates multiple outcomes to test how investments might perform under various conditions.

Ai In Competitive Analysis

Understanding the competition is vital. AI tools compare industry players with ease. They measure strengths, weaknesses, and market positions. Private equity firms use AI to spot trends and competitive advantages. Investment decisions become sharper.

| Feature | Benefit |

|---|---|

| Benchmarking Analysis | Identify where a company stands against competitors. |

| Market Trend Tracking | Spot emergent industry patterns ahead of others. |

| Predictive Analysis | Foresee potential market shifts and plan accordingly. |

Challenges And Considerations

Challenges and Considerations in leveraging AI tools for private equity present a complex landscape. Private equity firms must navigate ethical dilemmas and regulatory frameworks. These scenarios require careful analysis to ensure AI integration aligns with industry standards and societal values.

Ethical Implications Of Ai In Private Equity

The integration of AI in private equity raises important ethical questions. Stakeholders deal with transparency, fairness, and accountability. Firms must evaluate how AI makes decisions. Responsible use of data and Avoiding biases in AI algorithms stand out as priorities. Ensuring trust between investors and firms remains a significant concern. AI must comply with high ethical standards to maintain integrity in private equity transactions.

Impacts on Employment also require attention. Firms should anticipate changes in job dynamics. They need to address the potential displacement of workers. New opportunities in AI-driven analytics and management should be highlighted.

Navigating Regulatory Frameworks

Regulatory environments are evolving with AI adoption. Private equity firms must stay informed about current and upcoming legislation. Compliance with data protection laws, such as GDPR and CCPA, is mandatory. Operations must align with international standards. This ensures seamless cross-border transactions.

AI tools in private equity must operate within a clear legal framework. Clear oversight mechanisms help mitigate risks associated with AI deployment. Ongoing dialogue with regulators enables firms to adapt to legal changes and avoid penalties.

The Future Of Private Equity With Ai

Artificial Intelligence (AI) is powering a new epoch in private equity (PE). AI tools offer unprecedented opportunities for data analysis and deal-making. Investors and firms gain insights that were once impossible to uncover. The integration of AI in PE promises smarter investments and a transformative edge.

Emerging Trends In Ai And Investment

The landscape of Private Equity is evolving with the rise of AI-driven strategies. Here are some emerging trends:

- Automated Due Diligence: AI speeds up research and risk assessment.

- AI-Enhanced Analytics: Firms get deeper into market and company data.

- Machine Learning Predictions: AI predicts industry shifts and company performance.

- Improved Portfolio Management: AI monitors investments in real-time.

- Algorithmic Deal Origination: AI finds potential deals faster than humans.

Preparing For The Ai Revolution In Private Equity

Firms must embrace AI to stay ahead. Here’s how they’re preparing:

- Invest in AI Technology: Building or acquiring AI tools is critical.

- Train Teams: Staff learns to use AI in daily workflows.

- Adopt a Data-Driven Culture: Decisions rely on data, not just intuition.

- Collaborate with AI Startups: Partnerships keep firms on the innovation forefront.

- Stay Compliant: Ethical and legal AI use ensures long-term success.

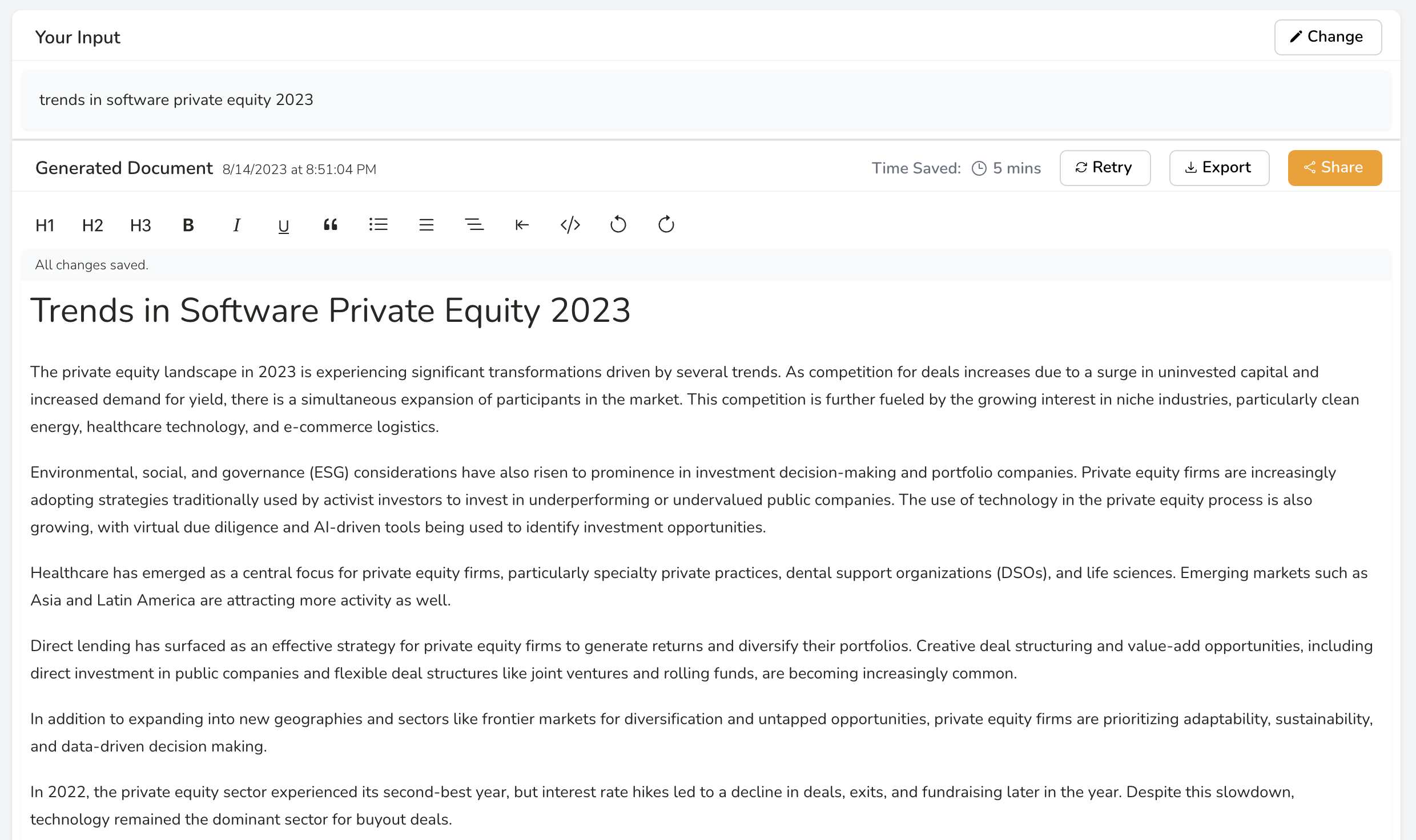

Credit: silatus.com

Frequently Asked Questions For Ai Tools For Private Equity

How Can Ai Be Used In Private Equity?

AI enhances private equity by streamlining deal sourcing, improving due diligence, optimizing portfolio management, and personalizing investor experiences. It also aids in risk assessment and predictive analytics for better investment decisions.

What Ai Is Elon Musk Investing In?

Elon Musk is investing in the AI company OpenAI, known for developing the AI chatbot ChatGPT. He also supports AI research for Tesla’s autonomous driving technology.

How Can Ai Be Used In Investments?

AI can optimize investment strategies by analyzing big data for market trends. It enhances portfolio management with predictive analytics and can automate trading for efficiency. AI tools assist in risk assessment and help investors make informed decisions quickly.

What Are The Top 3 Ai Stocks To Buy Now?

Three top AI stocks to consider are NVIDIA Corporation (NVDA), Alphabet Inc. (GOOGL), and Salesforce. com Inc. (CRM). Each company leads in AI innovation and has strong market positions.

Conclusion

Embracing AI tools in private equity is no longer a futuristic concept. They streamline due diligence, enhance data analysis, and personalize investor communication. For PE firms aiming to thrive, staying current with AI advancements is crucial. Start integrating these technologies and witness your investment strategies transform.

The future of private equity is intelligent, and it’s time to be a part of it.